child care tax credit 2022

In 2022 you can qualify for the full 2000 child tax credit if your MAGI is below 200000 for single filers or 400000 for joint filers. The 2022 Child Tax Credit can be a lifeline for so many families still struggling to recover from the pandemic.

Family Child Care 2022 Tax Workbook And Organizer Redleaf Business Series Copeland Jd Tom Porter Bill 9781605547923 Amazon Com Books

Families could be eligible to.

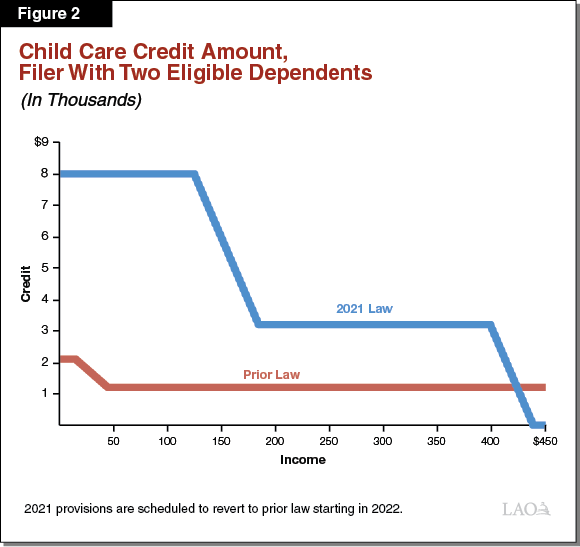

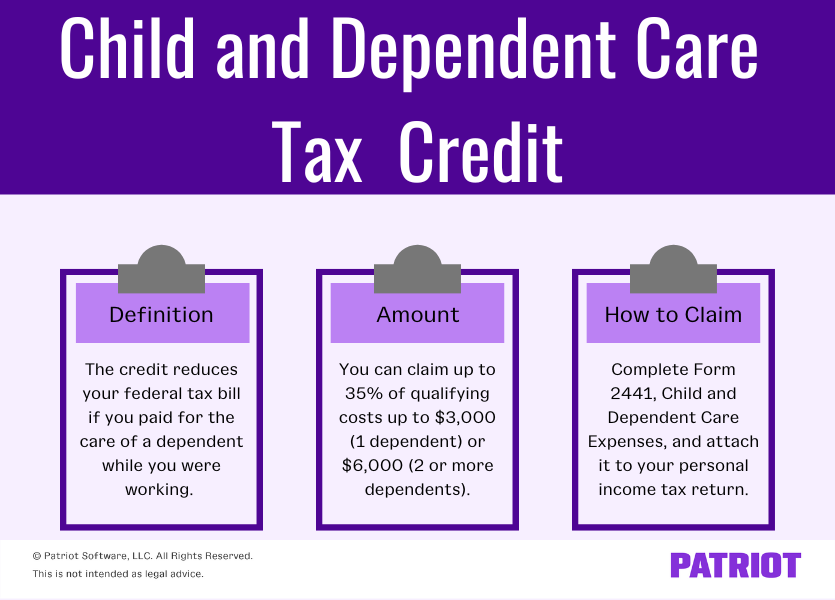

. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100. Abc27 Evening Newsletter Families earning more than 43000 can receive 180 if they have one child or 360 if they have multiple children. 2021 Child Tax Credit Basics These FAQs were.

Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth. Census Bureau data released on September 13 the US child poverty declined 46 from 97 in. The total credit is as much as 3600 per child.

Reverts back to up to 2000 for 2022 2025. Those earning less than 43000 can. As of now the child tax credit is worth 2000 per.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. Enhanced child tax credit. That is why the Wolf Administrations 2022-23 state budget includes a brand-new program called the Child and Dependent Care Enhancement Program which is modeled after.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. This means the family will receive a tax break of 1200 bringing their total cost to. For 2023 the full value of the adoption credit is available to eligible taxpayers with a modified AGI found on your tax return of up to 239230 up from 223410.

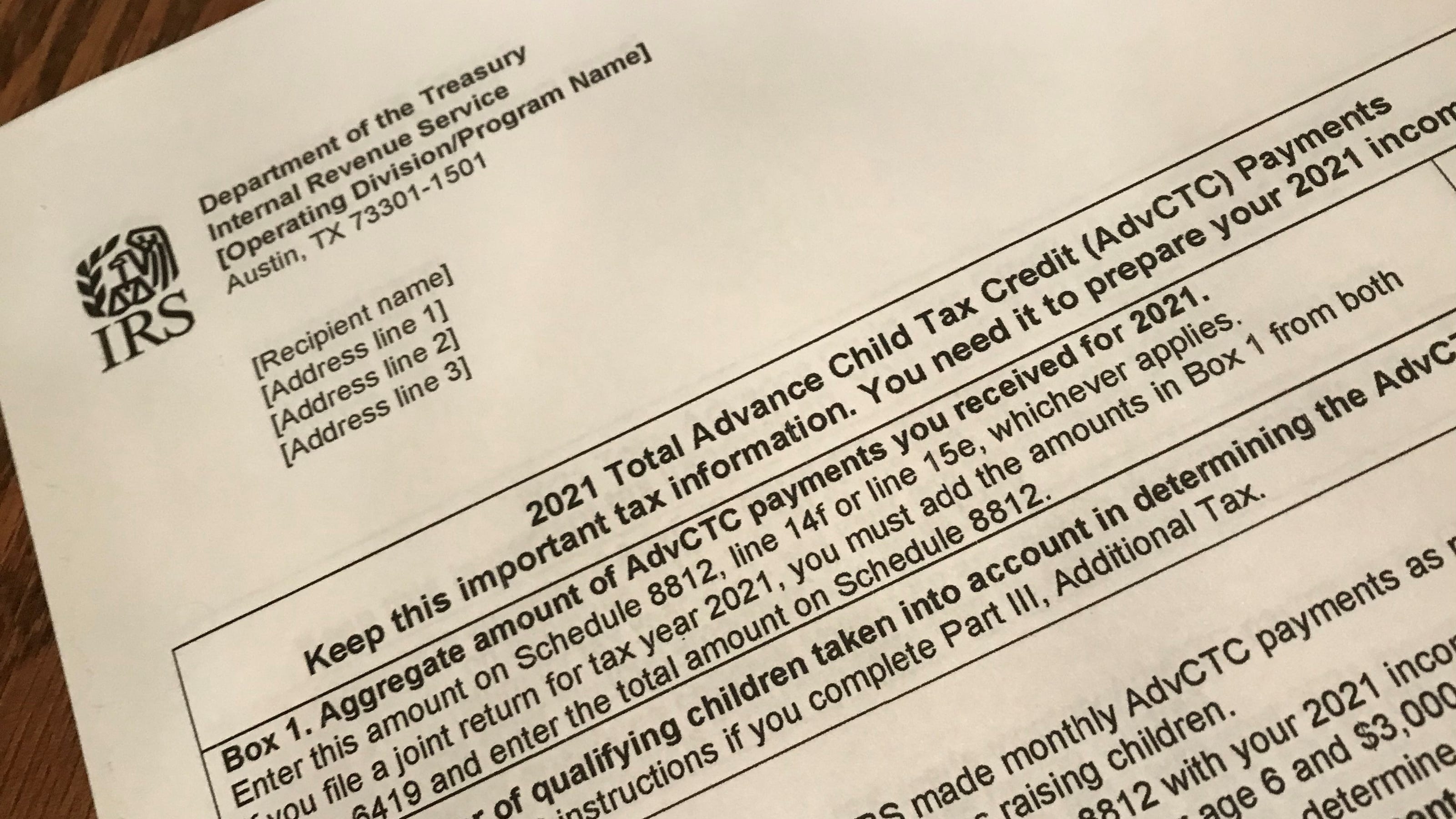

How Much Tax Credit Including. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early. In addition filers may also qualify for two other expanded tax credits.

Single or married and filing separately. At an IRS reimbursement rate of 35. For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows.

This means that the credit will revert to the previous amounts. 1200 sent in April 2020. The American Rescue Plan increased the Child Tax Credit from 2000 to 3600 per child for children under the age of six from 2000 to 3000 for children over the age of 6.

Up to 4000 for one qualifying person for example a dependent. Households must have a combined income of less than 15000 to get the maximum 1050 for one child or 2100 for two or more children. After those thresholds the credit reduces.

Individuals Child Tax Credit Tax Year 2021Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic A. Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

Published Mon Oct 17 2022 142 PM EDT Updated Mon Oct 17 2022 418 PM EDT. There are seven federal income tax rates in 2023. Their income level translates to a 20 tax credit which they can take on 6000 of their child care expenses.

The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease. 26th Sep 2022 0900 Child Tax Credit overall decreased poverty According to US. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. It will help them buy groceries pay rent or catch up on any. To apply applicants should visit.

Tax Credit Expansions In The American Rescue Plan

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Child And Dependent Care Credit H R Block

City Of New York On Twitter We Ll Help You Get Your Money Claiming Even One Of These Credits Could Return Thousands Of Dollars To You In 2022 Child Tax Credit

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

Child Care Tax Breaks You Need To Take Advantage Of In 2022

What Is The Child Tax Credit Tax Policy Center

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

How The Child And Dependent Care Tax Credit Helps Families

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

Irs Offers Overview Of 2021 Tax Provisions In American Rescue Plan Nstp

Taxes 2022 Are You Eligible To Claim The Child And Dependent Care Tax Credit Gobankingrates

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

Child Tax Credit State S New Child Care Tax Credit Allows Up To 6 000 Marca

Child And Dependent Care Credit Reducing Your Tax Liability

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities